Business Insurance in and around Abilene

Searching for coverage for your business? Search no further than State Farm agent Amanda West!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

You've put a lot of blood, sweat, and tears into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a flower shop, a veterinarian, a pharmacy, or other.

Searching for coverage for your business? Search no further than State Farm agent Amanda West!

Helping insure small businesses since 1935

Protect Your Future With State Farm

When one is as enthusiastic about their small business as you are, it makes sense to want to make sure all systems are a go. That's why State Farm has coverage options for artisan and service contractors, commercial liability umbrella policies, worker’s compensation, and more.

Let's discuss business! Call Amanda West today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

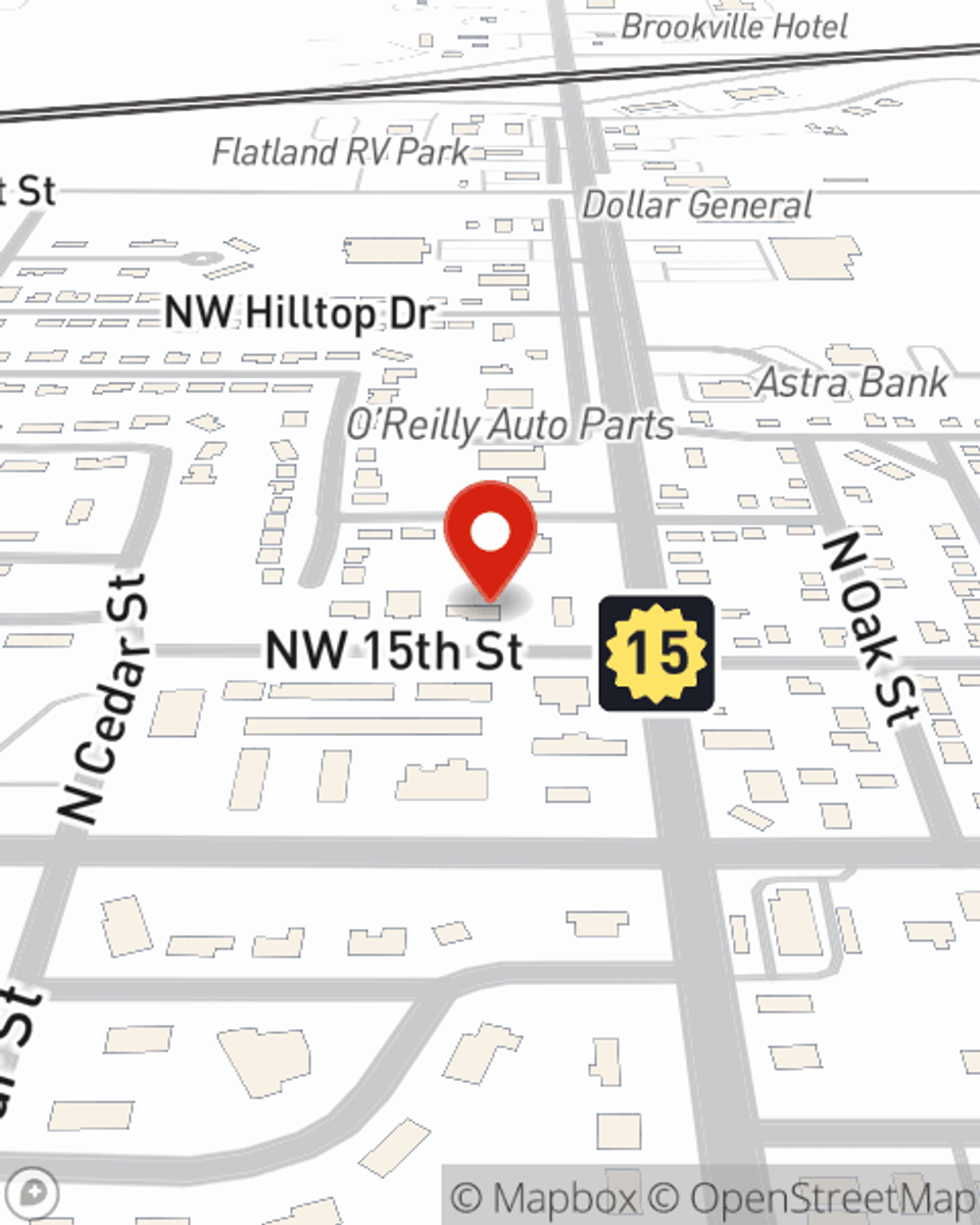

Amanda West

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.